John Mansker 407-399-9261

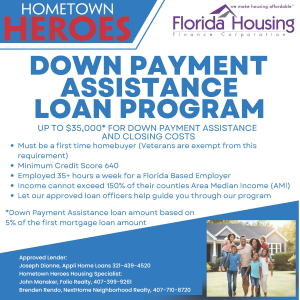

Florida’s Hometown Heroes Program, with a $100M boost, offers up to $35K in assistance. Average awards of $15K-$18K cover most costs, minimizing expenses.

ORLANDO, FL, UNITED STATES, June 26, 2024 /EINPresswire.com/ — Exciting News for Florida Homebuyers: $100M Boost for Hometown Heroes Program

As the July 1st launch date for Florida’s Hometown Heroes Housing Program approaches, anticipation is building among potential homebuyers. This program, designed to assist community workers, is set to receive a substantial $100 million funding boost. This significant investment underscores the state’s commitment to making homeownership more accessible and affordable for those who serve and enhance their communities.

Program Enhancements and Expanded Impact

The infusion of $100 million will significantly expand the program’s reach, offering up to $35,000 in down payment and closing cost assistance. The average award ranges between $15,000 to $18,000, which is often enough to cover both the down payment as well as the majority of closing costs. This allows buyers to come in with minimal cash out of pocket. The program aims to bridge the gap between rising home costs and wages, making homeownership more accessible for those who serve and enrich their communities. With this new funding, the program is set to extend its support to a larger number of community heroes, ensuring that they can afford to live in the communities they contribute to.

Eligibility and Application Insights

The program is open to first-time homebuyers or those who haven’t owned a home in the last three years. Applicants must be employed full-time by an organization with a physical presence in Florida, working at least 35 hours a week, and must earn less than 150% of the Area Median Income (AMI) for their county. These criteria are designed to ensure that the program serves those who need it most and to help build stronger, more stable communities.

Building Stronger Communities

“We have seen an increase in pre-approval volume from first-time homebuyers in anticipation of the program’s release on July 1st. That will be the first date we are able to lock in the rates for the buyers,” said Joseph Dionne, Managing Partner of Appli Home Loans. We have even set up a special webpage for home buyers to start the application process.

Preparing for the Launch

With the infusion of $100 million, the program is expected to see a surge in applications. Prospective homebuyers are encouraged to begin preparing now to ensure they are ready to apply when the program opens. Here are the top five steps to get ready:

1. Review Eligibility Criteria:

Ensure you meet the program’s eligibility requirements, including being a first-time homebuyer or not owning a home in the last three years, and working full-time for a company based in Florida with a minimum of 35 hours per week.

2. Gather Required Documentation:

Start preparing the necessary documents, including proof of employment, income verification, and residency. Having these documents ready will streamline the application process and increase your chances of securing assistance.

3. Understand Income Limits:

Verify that your income is within 150% of the Area Median Income (AMI) for your county. This information is crucial as it ensures you qualify for the program and helps prioritize those who need it most.

4. Contact a Qualified Lender:

Reach out to a qualified lender such as Joseph Dionne of Appli Home Loans for financial guidance and pre-approval. Working with a knowledgeable lender can help you understand your financing options and prepare for the application process.

5. Contact an Experienced Agent:

Consult with an experienced real estate agent such as John Mansker of Folio Realty or Brenden Rendo of NextHome Neighborhood Realty. These agents can provide valuable insights and assistance throughout the home buying process, ensuring you find a home that meets your needs and budget.

Future Goals and Continued Support

As the Hometown Heroes program evolves, it aims to adapt its offerings to better meet the needs of Florida’s diverse population. Future plans include increasing funding, broadening eligibility criteria, and enhancing support services to guide applicants through the complex process of buying a home. The program’s commitment to continuous improvement ensures it remains a vital resource for community heroes.

Conclusion

The excitement surrounding the Hometown Heroes Program continues to grow as the launch date nears. With this substantial funding boost, more Floridians will have the opportunity to achieve their dream of homeownership and contribute to the stability and growth of their communities.

Prospective homebuyers are encouraged to prepare for the July application opening by reviewing eligibility criteria, gathering necessary documentation, and consulting with qualified lenders and experienced real estate agents. Comprehensive program details, including eligibility requirements and application guidance, are available online at the Hometown Heroes Down Payment Assistance loan program or through direct contact with program representatives.

To learn more about the program and how it can help you achieve your dream of homeownership, visit the Hometown Heroes Program’s blog post on Florida qualification today.

John Mansker

Folio Realty

+1 407-399-9261

johnmanskerrealty@gmail.com

Visit us on social media:

Facebook

LinkedIn

YouTube